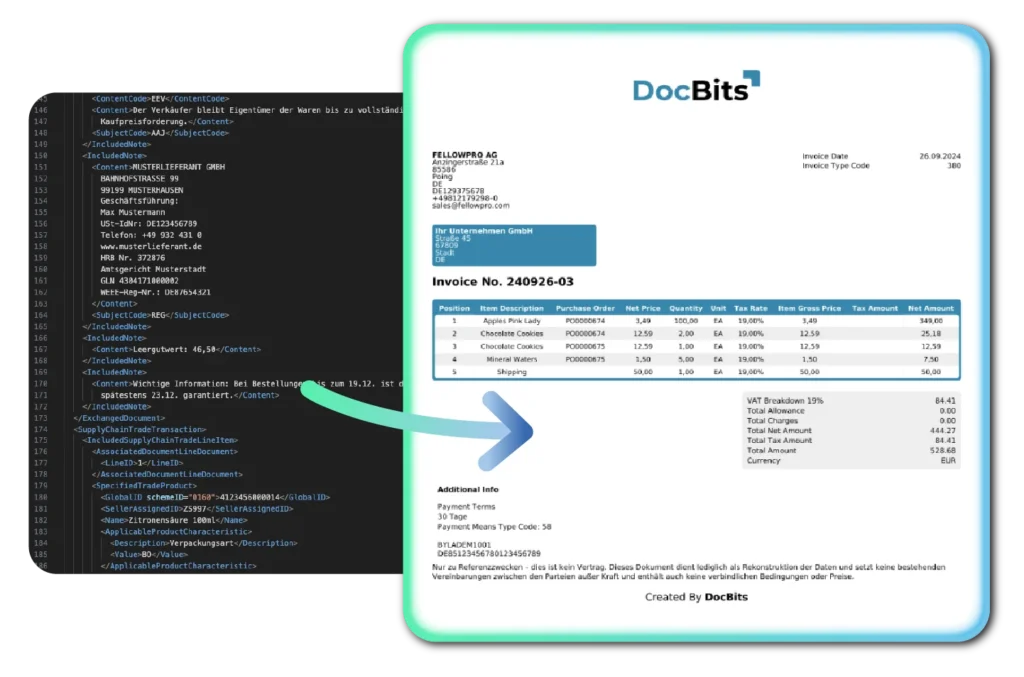

DocBits provides you with the tools for the electronic exchange of business documents.

An e-invoice (electronic invoice) is a digital document that contains all the necessary invoice information in a structured format. It replaces the traditional paper invoice and enables automated and more efficient processing. E-invoices offer advantages such as faster transaction processing, reduced susceptibility to errors and cost savings.

E-invoicing will be mandatory for companies in Germany from 2025. This obligation is part of the government’s efforts to drive digitalization and increase efficiency in accounting.

There are different formats for e-invoices, which vary depending on the country and legal requirements:

A European network and infrastructure that enables companies and public administrations to exchange electronic invoices and other documents in a standardized and secure manner.

Standard format in Germany for electronic invoices to public clients. It is XML-based and complies with the European standard EN 16931.

A hybrid format that contains both a structured XML file and a visually readable PDF file. It combines the advantages of both formats.

The official format for electronic invoices in Italy, which is mandatory for invoicing to the public administration. It is transmitted in XML format.

A component of the Swiss QR-bill system. It contains all the necessary invoice information in a QR code, which facilitates machine-readable processing.

Process invoice data in accordance with official, country-specific requirements. Regardless of whether you work with XRechnung, ZUGFeRD, Fattura PA or the Swiss QR code, DocBits enables seamless and automated processing.

The DocBits document processing platform offers a centralized solution for the automated processing of e-invoices, regardless of their format, in accordance with the technical and legal requirements of the DACH region.

Since April 18, 2020, all federal states have been legally obliged to accept electronic invoices. Each federal state can implement the directive in accordance with its own regulations, but the electronic systems and formats specified in Directive 2014/55/EU must be used.

In Austria, public institutions at federal, provincial and municipal level and their suppliers must use electronic invoices. Central authorities are obliged to submit their electronic invoices via the national platform eRechnung.gv.at, which is connected to the PEPPOL network.

In Switzerland, public administrations and some of their suppliers are obliged to issue invoices electronically if the order value is 5,000 Swiss francs (approx. €4,594.57) or more. In the private sector, use is voluntary.

Das für das E-Invoicing unter Privatunternehmen genutzte System ähnelt dem der öffentlichen Verwaltung. Unternehmen können E-Rechnungen und entsprechende Mitteilungen über das Sistema di Interscambio (SdI) senden und empfangen. Seit 2014 ist die E-Rechnung mit öffentlichen Verwaltungen (FatturaPA) verpflichtend, und seit 2019 gilt dies auch für private Unternehmen. In the healthcare sector, the government has also integrated the sending and collection of electronic orders via the NSO system into the invoice flow.

Electronic invoicing was introduced in France as early as 1990 and was therefore ahead of the European directives. EDI invoices are used most frequently, supplemented by additional procedures. Since 2020, both public administrations and their suppliers have had to issue their invoices electronically. There are also plans to gradually extend this obligation to the B2B sector between 2026 and 2027.

Poland is continuing its project to intensify e-invoicing among private companies. In the B2G sector, e-invoicing is mandatory for public administrations and voluntary for their suppliers. From February 2026, mandatory e-invoicing in the B2B sector will be gradually introduced via the KSeF platform.