With our revolutionary solution for automated invoice processing, you can enter your invoices automatically and efficiently. It does not matter whether it is a cost or goods DocBits.

Capturing all the typical contents of an invoice, reconciling your data with your systems, extracting document data down to item level, and processing complex tables is no problem with DocBits and can be done in just a few moments.

DocBits leverages cutting-edge AI and ML algorithms to extract vital data from invoices and documents with unparalleled accuracy, reducing manual labor and accelerating your workflow. Our state-of-the-art OCR technology goes beyond simple text recognition. It’s capable of extracting and processing intricate tables that include customer & supplier item numbers, quantities, unit information, and various item descriptions. This means you can handle even the most complex invoices effortlessly. The result? A streamlined, efficient process that saves you both time and resources, fully integrated with your Infor ERP system.

DocBits supports international invoice types (e-invoicing). Common methods such as the EDI format, the Swiss QR code or the Italy XML Factura are part of the standard scope. If necessary, any other methods can be included and made available at short notice.

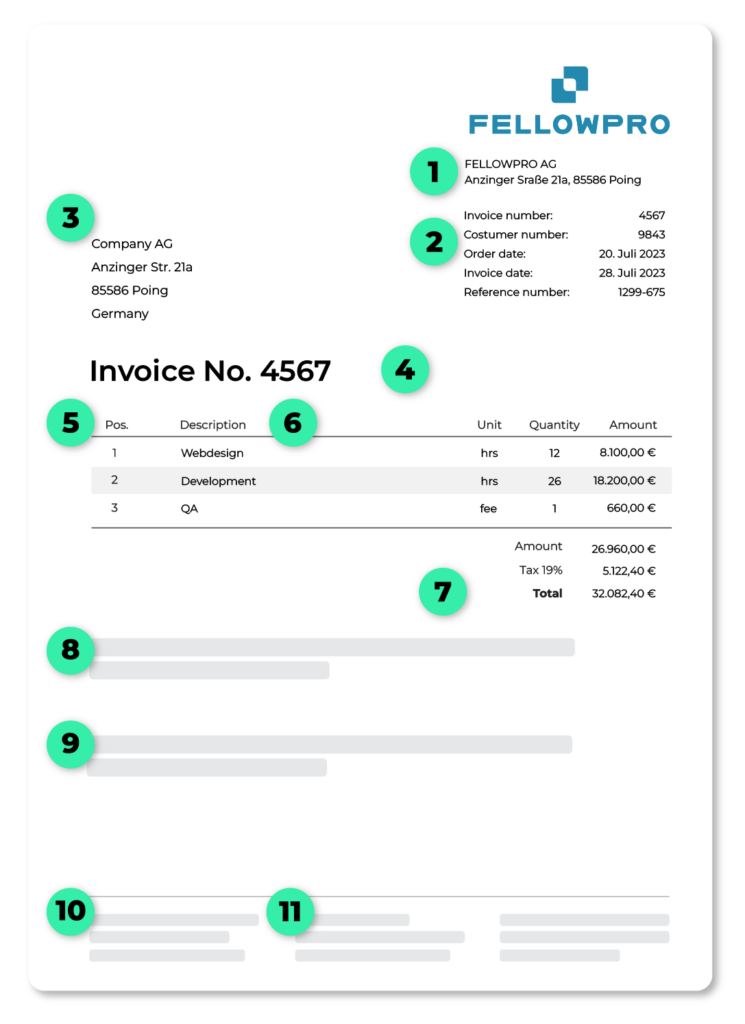

An invoice should contain the full name and address and contact details of the company issuing the invoice, i.e. the supplier.

The issue date of the invoice is important for accounting and should therefore be clearly stated. If the provision of a service deviates from the invoice date or is not documented by a delivery note, the date (or the period) should be shown on the invoice.

An invoice should also contain the name, address and contact details of the customer (invoice recipient).

A sequential unique invoice number simplifies the tracking of payments and correspondence.

These contain, often in complex tabular form, data such as customer and supplier article numbers, quantities, units, etc.

An invoice should contain a detailed description of the quantity, type and time of delivery or service.

An invoice should clearly state the invoice amount. This should be broken down into net amount, tax rate, tax amount and gross amount, which may vary depending on the country and type of service.

An invoice should contain clear payment terms, such as the specified payment period, the payment term and the accepted payment methods.

Any additional information or notes that may be relevant to the Buyer, such as special payment or contact instructions, or even discounts, may occasionally appear on an invoice.

An invoice should also contain the seller's bank details, including account name, account number and routing number, to enable the buyer to transfer the amount due.

This includes the tax number (tax ID) or sales tax ID (USt ID number) of the company providing the service.

DocBits can revolutionize efficiency by changing the way your business ingests external data. The advanced features, seamless integration with your accounting, ERP and/or DMS system, and user-friendly interface make DocBits a must-have tool for companies looking to streamline their processes and stay ahead of the competition today.

Contact us today to learn more and arrange a customized demo for your business. We look forward to showing you how DocBits can help you save time and money while increasing your productivity.